Wow!

One third of the way through the second quarter of 2022 and there’s no lack of concerning information out there pertaining to the state of the current, local real estate market. Let’s break it down.

If you’ve worked with me in the past, you should know I’m a straight shooter. If I assisted you with your mortgage financing years ago, you’ll probably understand that I’m an advisor to my clients more than anything else. In other words, it was never my goal to “sell you” a mortgage loan. If I represented you as a home buyer as your Realtor®, then you understand it was never my goal to “sell you” on a particular home. If I was your listing agent, though, then you understand that my goal was to sell the absolute heck out of your home and get you the absolute highest and best sales price. Even then, though, I was selling your home, not you!

It's important for me to note that the field of Real Estate (and, similarly, real estate finance) is a realm where one shoe never fits all. Decisions need to be specific to individual situations. Advice, as well, must always be tailored to specific situations. There are very few “absolutes” out there as far as real estate advice. While the information I’ll review in this article paints a particular picture of what we’re seeing in action today, it does not predict the future and should not be viewed as an opinion really at all. To effectively form an opinion about what makes sense for you, individually, I would need to talk to you about your particular situation and your goals. Also, things in real estate change quickly (and, at times, not quickly enough). The main factor that I’ll discuss here that’s changed quickly is mortgage rates and how the increase in rates coupled with the increase in median and average local home prices is affecting affordability.

Mortgage Rates on the Rise

These first four months of 2022 have seen mortgage rates rise considerably. Throughout 2021 when the average 30-year fixed rate mortgage rate was about 2.96%, (1) I frequently discussed how an increase to 4.5% (the average 30-year fixed rate in January of 2019) would reflect a considerable 50%+ increase in rates. You don't see that kind of move very often. Today, we’re seeing the 30-year fixed rate mortgage at about 5.00% (2) with every indication (Inflation concerns, Federal Reserve, etc.) pointing towards us seeing this increase even more in the near future. When you think about it, even at 5.00%, the 30-year fixed is below the current annual rate of inflation. You don't really see that happen too often either. If we used an example of $100,000 amortized over 30 years at 2.96% it produces a monthly payment of $419.45 versus a monthly payment of $536.82 for $100,000 amortized at 5.00%. That’s an increase of approximately 28% in monthly payment as far as principal and interest payment. That has quite an impact. Start with home buyers (especially first-timers) qualifying for less of a purchase price.

Home Value Appreciation Since 2013

The first few months of 2013 was a really significant turning point in the local market coming out of The Great Recession. We saw the median sales price for single family homes in the greater Los Angeles area increase from $335,000 in January of 2013 to $349,000 in February and then hit $380,000 and then $405,000 in March and April, respectively. Nearly a 21% increase in prices in 4 short months. As it became evident that the worst was behind us, so to speak, it makes sense that prices appreciated so considerably over that short 4-month period of time. Mortgage interest rates during that period were steady at around 3.50% during that entire time in a narrow range.

So far in 2022, we’ve seen the same areas' median home price increase from $765,000 in January to $780,000 in February and $837,500 in March. (3) Month to date, in April, that median sales price stands at $875,000 (3). This represents a 14% increase in median sale price, year-to-date with demand clearly being fueled by consumer fear of missing out on still historically low mortgage rates as they seemingly continue to rise.

Let’s focus on March of 2013 versus March of 2022 because that’s the most recent full-month data that we currently have available.

In 9 years, the median sales price for a single-family residence in the greater Los Angeles area has increased over 120%. A staggering number. It’s increased over 58% in the past five years since 2017. According to Freddie Mac, the average 30 year fixed was 3.57% at .8 points fees/costs in March of 2013 and 4.20% at .5 points fees/costs in March of 2017. (4) Rates have been kept low for a "considerable period" of time following the mortgage meltdown and financial crisis, as the Fed indicated all along. It’s very clear to see that the most recent years (2021 and 2022) market demand has been fueled by historically low mortgage rates, among other factors, but the lowest rates in modern history being the most significant of all.

Affordability

I don’t have a crystal ball but I can tell you that we’re about to see the local affordability index drop off a cliff here in the greater Los Angeles area. The affordability index is data that’s reported by the National Association of Realtors on a monthly and quarterly basis. (7) It’s reported on the national level and broken down into metropolitan areas. When 2021 ended, it was widely reported that about 25% of the population of Los Angeles County could afford to buy a home. Of course, home prices have increased considerably over the first four months of 2022 and, interest rates, even more so. Toward the end of 2017, according to an article in Daily Breeze, a median-priced Los Angeles County home was affordable for approximately 22 percent of Los Angeles County households (5). In November of 2017, the median sales price for single family residences in the greater Los Angeles area was approximately $550,000 (average $780,000), while the average 30-year fixed mortgage rate at that time was 3.92% with approximately .50 points in fees/cost, according to Freddie Mac. While the median sale price for a single-family home increased to about $780,000 (average $1,120,000) by December 2021, the affordability index improved because the average 30-year fixed just five months ago was 3.10% with approximately .60 points in fees/costs. It’s also important to note that the reported median household income for Los Angeles metropolitan area increased from $64,912 annually in 2017 to approximately $80,000 annually in 2021. (3)(4)(6)(7)

With current median sale price along with current mortgage rates increasing considerably and household income remaining relatively the same for the past 5 months, one can see the affordability challenge we are currently facing here in Los Angeles. Without a major increase in median household income over the past 4 months or so and factoring in about a 14% increase in home prices at a range of 5.00% mortgage rate (versus 3.00% range), we should see a massive decrease in affordability when the index figures are next reported by N.A.R. Anyone want to take the over/under on 20%?

Let's take a look -

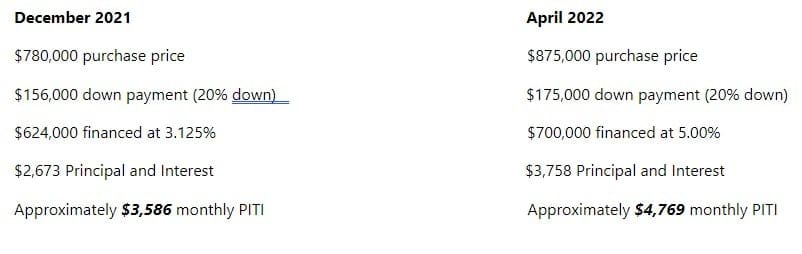

This example shows that the total monthly payment for a median-priced home in and around Los Angeles costs 33% more in monthly payment today than it did 5 to 6 months ago. It also requires about $19,000 more of a down payment!

So, What Happens to Home Prices?

While affordability is obviously a very important factor, it potentially affects only the “demand” side of the equation. Demand for homes will subside simply because of the number of households in Los Angeles that are being priced out of the market due to increased price coupled with increased mortgage rates (assuming both of these things continue to happen).

As I wrote about in my last market update, market prices are in direct correlation with supply AND demand. Supply is still historically very low here in Los Angeles. Perhaps with lesser demand it will build up to a healthier level in the near term and help balance the market. We must see just how much demand, itself, is affected by what will likely be seen as a significant decrease in affordability.

Supply Factors

While we are likely seeing demand start to fall off a bit right now, there are several factors keeping supply at record lows. One of these factors is that builders didn’t build enough homes during the decade following the financial crisis. This has been widely discussed and referenced for years and cited as one of the top reasons that we've been supply-challenged. Another factor that we can’t ignore is that mortgage rates were at or below 3.00% for nearly two years, allowing homeowners to refinance (or purchase) their homes at rates that are at about a 40% to even 50% discount to what is currently available today. I believe many current homeowners that potentially would sell their current home and look for something bigger or downsize are, in essence, handcuffed to their current, extremely low mortgage rate. Basically, they look to renovate and add square footage or split the home to create a junior ADU.

One last factor I want to mention is hedge funds. During the financial crisis, hedge funds started to acquire homes. A lot of homes. They didn’t stop buying either when the end of the financial crisis came. The name of their game is yield. They have deep pockets, and they can pay a premium for single-family homes throughout the country. Rising rents, of course, plays right into their hands. While Los Angeles hasn’t been a major target for these hedge funds and corporations in the past, who knows what happens should the local tide turn a bit. In other parts of the country, this is a huge problem. First-time homebuyers simply cannot compete with the deep pockets of a hedge fund or large corporation. While this practice was a major turning point during the financial crisis, it remains to be seen how it impacts the market going forward and if it even becomes a factor for us locally in Los Angeles at some point in the future. Certainly, if we do start to see any significant number of local foreclosures, the banks will likely look to these hedge funds and corporations so that they can unload the inventory and not flood supply into the market thereby depressing prices.

What Does This All Mean for Me?

So, as I started out stating, one shoe never fits all. Decisions need to be specific to individual situations. I’ve outlined above numerous facts and current factors affecting the current market. If you have some ideas and goals that you’d like to discuss, I’m always available to you! In fact, the number one thing that dictates what your best decisions might be is your current set of circumstances. Your situation. That’s it. Layered together with what’s happening with the market is the space where I can help you find the right answers for YOU.

Nobody can predict the future or accurately time any market. Market timing is elusive. We never can see the top or bottom until the top or bottom is clear in hindsight.

While we can’t predict the future, we can, indeed, make informed decisions. I’m here to help you do just that! Call, text or email and we can chat.

See Ken’s Past Sold Homes Here

Read Some of Ken’s Reviews Here

Citations

- Business Insider https://www.businessinsider.com/personal-finance/average-mortgage-interest-rate

- Bank of America Mortgage Rates https://www.bankofamerica.com/info-home-loans/competitive-rates/?subCampCode=90472&dmcode=18099607378&cm_mmc=CRE-SD1-_-MSN-PS-_-ME4LT0000_bank%20of%20america%20mortgage%20rates-_-PS_MSN_Brand_Rates_DeskURLs_4__607378&gclid=1a6126f39e141e52ad05449bcafb4a60&gclsrc=3p.ds&msclkid=1a6126f39e141e52ad05449bcafb4a60

- Combined Los Angeles West-Side MLS (TheMLS) www.themls.com

- Freddie Mac Historical Rates https://www.freddiemac.com/pmms/pmms30

- Daily Breeze https://www.dailybreeze.com/2017/11/02/you-need-to-earn-159000-a-year-to-buy-the-typical-orange-county-house-realtors-report/

- FRED - St Louis Fed https://fred.stlouisfed.org/series/MHICA06037A052NCEN

- National Association of Realtors NAR Affordability Index https://www.nar.realtor/research-and-statistics/housing-statistics/housing-affordability-index